Close Up On Small Claims Judgments & Background Checks

Find out how you can use a civil court check to learn about small claims judgments, and how to use the results to make informed hiring decisions.

Resourcesarticles

Ashley Blonquist

8 min read

Depending on the positions you’re hiring for, a bankruptcy on a candidate’s record may provide important information. But which type of civil court background check should you use? We’re breaking down what you need to know.

Unlike criminal background checks, Civil Court Background Checks don’t report criminal convictions about your candidates. Instead, these checks provide information about candidates at the civil court level, including:

Depending on the type of position you’re hiring for—and the information you want to screen for—there are different types of Civil Court Background Checks employers can conduct to make the most informed hiring decisions.

These types of checks are typically conducted for positions that require working with or managing finances. That’s because employers benefit from additional information and insight about candidates who will be working in these positions, especially any claims that may involve fines, disputes, liens, foreclosures, tax disputes, and bankruptcies.

As a result, background information gathered from the screening may indicate to employers that candidates may not make responsible decisions regarding handling finances.

It depends on the type of background check an employer conducts. Here’s a quick breakdown of when a bankruptcy shows up on a background check:

Bankruptcies won’t show up in the results of criminal background checks, as those screenings provide information about criminal records and histories, including felony and misdemeanor criminal convictions and pending criminal cases. Filing bankruptcy is not a crime and is therefore not filed in a criminal court.

Bankruptcies are not included in Civil Court Background Checks, including Upper and Lower Civil Courts and Federal Civil Court Checks.

A Federal Bankruptcy Search checks federal bankruptcy courts for any bankruptcy filings. These results will reveal any Chapter 7, Chapter 11, and Chapter 13 bankruptcies going back a maximum of 10 years, as outlined by the Fair Credit Reporting Act (FCRA).

Search results from a Federal Bankruptcy Search may also include:

So, what does each type of the bankruptcy filing mean, and why should the results matter to you, as an employer?

Those who file for Chapter 7 bankruptcy are only allowed to do so if the court determines a person doesn’t have enough income to pay off their debt—typically done through what’s called a means test. Chapter 7 is the most common type of bankruptcy filed, making up 70% of all personal bankruptcies in 2020.

When this happens, a person’s assets—or anything that’s of value—goes into liquidation to pay off outstanding debts to creditors. Except for debt like federal taxes and student loans, any remaining debt is typically discharged within four to six months.

However, nearly all Chapter 7 bankruptcies are filed by people who don’t have enough equity to pay back creditors, or their property is protected under state exemption laws. As a result, their property can’t be sold by the trustee overseeing the case.

Those who enter Chapter 13 bankruptcy typically do so because they’ve fallen behind on loan payments. However, Chapter 13 bankruptcy is different from Chapter 7, as the filer is allowed to keep their assets, so long as they agree to pay off a portion of their unsecured debt—like medical bills and credit cards—through a court-mandated payment plan.

This type of bankruptcy halts any foreclosures or asset repossession while the court calculates the monthly payments based on the filer’s income and outstanding debt. Once the filer has completed their payment plan—usually anywhere from three to five years—any remaining unsecured debt will likely be discharged. Those qualified to file for Chapter 13 bankruptcy must have less than $419,275 in unsecured debt and less than $1,257,850 in secured debt.

Businesses can also file for Chapter 7 and Chapter 13 bankruptcies but can also qualify for Chapter 11, which is generally referred to as reorganization bankruptcy (like a personal Chapter 13 bankruptcy).

For businesses that file Chapter 7 bankruptcy, no assets are exempt from liquidation. In these cases, owners surrender their business and assets to a trustee, who sells them to pay off outstanding debt to creditors. Once this process is complete, everything else like credit cards, loans, contracts, and leases are generally written off by creditors (vs. being discharged like they are in personal Chapter 7 bankruptcies).

Chapter 13 bankruptcy is generally filed by small business owners who don’t want to enter into liquidation; they would rather fight to stay above water by paying back their outstanding debts. Like a personal Chapter 13 bankruptcy, the small business won’t surrender its assets. Instead, it will enter into a court-appointed repayment plan that outlines how much is owed each month and for how long.

In simplest terms, a Chapter 11 bankruptcy essentially buys at-risk businesses more time. It allows them to reorganize and restructure their business to make it more profitable—all while protecting themselves from creditors. If the reorganization (and interim repayment plan) isn’t successful, all businesses’ assets will go into full liquidation.

Bankruptcy information can be crucial when hiring for positions in which candidates will have direct or easy access to finances and sensitive financial information. That’s because you need to feel confident that you can trust your employees to make smart decisions for the company and protect its assets.

If a Federal Bankruptcy Search reveals a candidate has filed for bankruptcy in the past seven to 10 years, it may indicate a mishandling of their own money and assets, which could be a risk for employers. Additionally, some employers may worry that candidates with outstanding debts and financial challenges may be more at risk of stealing or embezzling from the company if they have access to finances.

As with any and all background screenings employers conduct for candidates, you are responsible for remaining compliant during the entire screening and hiring process. Employers need to adhere to the FCRA, which protects the rights of candidates and employees and gives them the right to know, understand, and dispute any findings of background checks that contributed to a hiring decision.

Further, it’s also important to remain compliant with your own organization’s screening policy to prevent discriminatory hiring practices and minimize risks to your company, such as litigation and fines.

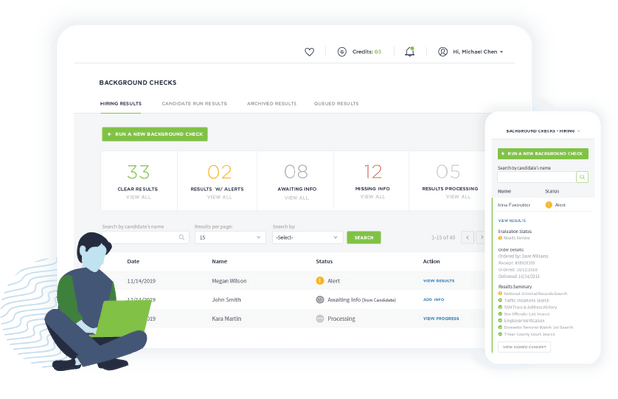

That’s why turning to a reputable Consumer Reporting Agency (CRA) like GoodHire to conduct Civil Court Background Checks is a smart move, and will save you time and resources in the long run. An FCRA-compliant background screener helps you maintain compliance with federal as well as local laws and regulations that govern employment screening.

As part of a comprehensive background check, Civil Court Background Checks—including Federal Bankruptcy Searches—give you more insight into candidates’ financial backgrounds, including bankruptcies filed within the past 10 years. With this information, you can more confidently:

GoodHire offers hundreds of screening options, including Upper & Lower Civil Court Checks, Federal Court Checks, and Federal Bankruptcy Checks.

The resources provided here are for educational purposes only and do not constitute legal advice. We advise you to consult your own counsel if you have legal questions related to your specific practices and compliance with applicable laws.

Find out how you can use a civil court check to learn about small claims judgments, and how to use the results to make informed hiring decisions.

Let’s take a closer look at which type of screening you would use to learn about tax liens, when you might use them, and what it means for your business.

When it comes to civil court background checks, what’s the difference between upper court vs. lower court? Here’s what you need to know about these searches.